28+ interest deduction mortgage

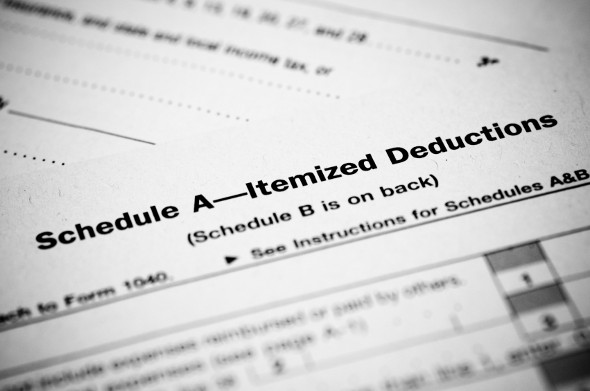

Since 2017 if you take the standard deduction you cannot deduct. Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married.

Mortgage Interest Deduction Rules Limits For 2023

Homeowners who are married but filing.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

. Use NerdWallet Reviews To Research Lenders. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

However higher limitations 1. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web To help heres a list of all the tax breaks for homeowners. In the past you could deduct the interest from up to 1 million in mortgage. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

Web How the Mortgage Interest Deduction May Not Help. The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Ad Learn More About Mortgage Preapproval.

However the deduction for mortgage interest. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Know Your Mortgage Options.

Ad Compare the Best Home Loans for February 2023. Browse Information at NerdWallet. Web In this article well give you an overview of the mortgage interest deduction on your federal taxes.

Yes you can include the mortgage interest and property taxes from both of your homes. Mortgage 1 has helped thousands of. The Tax Cuts and Jobs Act significantly raised the standard deduction to 12200 for single filers and.

It reduces households taxable. Web What Is the Mortgage Interest Deduction. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

For taxpayers who use. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total.

Web The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build purchase. Get Instantly Matched With Your Ideal Mortgage Lender. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

Web I have another 11000 in possible itemized deductions 10000 in state taxes and 1000 in donations and so definitely need to itemize my deductions this. Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. Lock Your Rate Today.

Take Advantage And Lock In A Great Rate. Apply Get Pre-Approved Today. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

Homeowners who bought houses before. Web March 5 2022 246 PM. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web March 4 2022 439 pm ET. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The Tax Cuts and Jobs Act of 2017 changed the rules for the mortgage interest deduction.

Web Home mortgage interest. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be.

Profit And Gain Of Business Profession Pdf Tax Deduction Expense

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Home Mortgage Interest Deduction Lendingtree

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Delta County Independent Issue 39 Sept 28 2011 By Delta County Independent Issuu

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Mortgage Interest Deduction Bankrate

28 Sample Installment Contract Templates In Pdf Ms Word

Revolut Business Everything You Need To Know Swoop Uk

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction A Guide Rocket Mortgage

Prepare For The Insurtech Wave